Wealthy people don’t need a huge, skewed income tax break ‒ but Alabama gives them exactly that. This loophole, called the federal income tax (FIT) deduction, overwhelmingly benefits rich households. It’s an imbalanced tax giveaway that reduces funding for public schools. And it increases the state’s reliance on regressive revenue sources, like the sales tax on groceries, that fall hardest on people who are striving to make ends meet.

A 1965 constitutional amendment created the loophole by allowing Alabamians to deduct federal income tax payments from their income before calculating state income taxes. This deduction doesn’t exist in most other states ‒ and for good reason! Only Alabama and Iowa allow individuals to deduct all federal income tax payments. (Louisiana had an FIT deduction until 2022.) Three other states ‒ Missouri, Montana and Oregon ‒ cap their FIT deductions at around $5,000. There, as here, the benefits go largely to those with the highest incomes.

A tax break for those who need it least

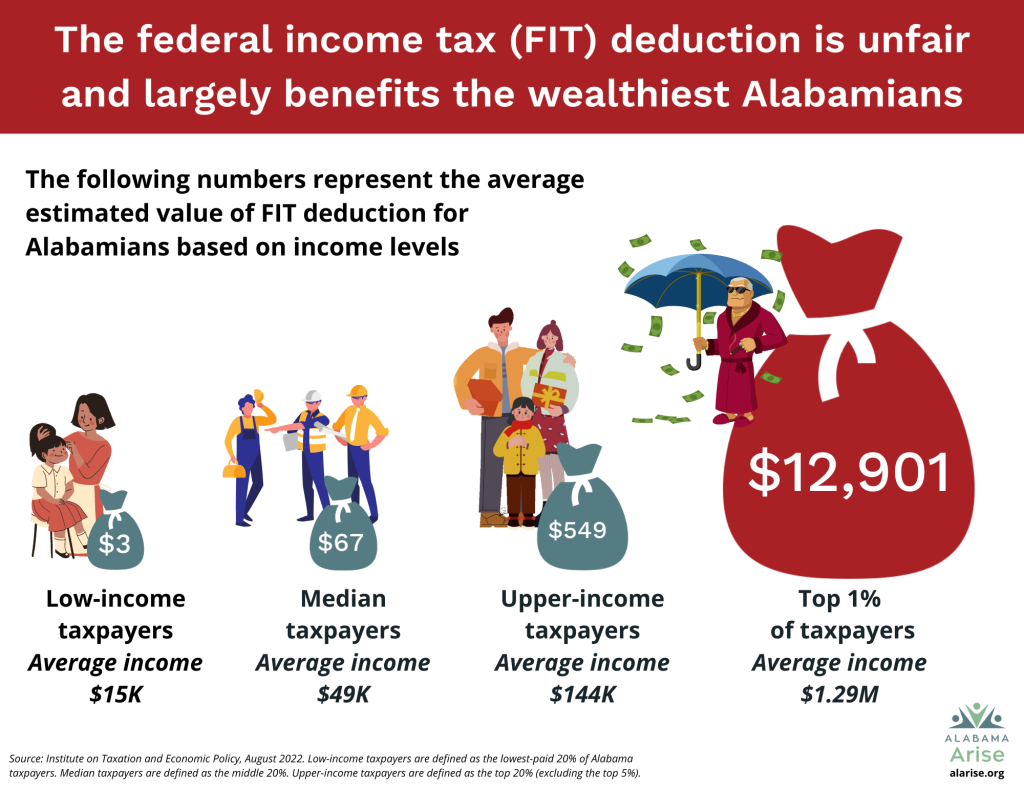

The FIT deduction primarily benefits wealthy households and does little or nothing for families with low and moderate incomes. Unlike Alabama, where the state income tax rate is nearly flat (with most people paying the same percentage of their income), the federal government taxes people at higher rates as their income goes up. This means rich people can use Alabama’s FIT deduction to exclude much more of their total income when calculating state income taxes. And that means the FIT deduction gives the biggest breaks to those who can most afford to pay to fund education, health care and other vital needs.

By contrast, the FIT deduction offers comparatively little benefit to people with low or moderate incomes. For Alabamians with incomes under $22,000, the FIT deduction is worth an average of $3 a year, the Institute on Taxation and Economic Policy (ITEP) estimates. In fact, for most people in our state, the deduction is worth less than $135 a year. But for the richest 1% in Alabama ‒ whose average income is $1.28 million ‒ the deduction is worth an average of $12,901 a year, ITEP estimates.

A path to untax groceries and support public schools

Ending or capping the FIT deduction would be an important step to improve Alabama’s upside-down tax system. And the effects for individual tax filers would be relatively modest. Even for the richest Alabamians, eliminating the FIT deduction would increase their taxes by only around 1% of total income on average. For most people in our state, the increase would be significantly less ‒ or none at all.

By ending this upside-down tax break for the rich, Alabama lawmakers could generate $833 million in new revenue. More than 85% of that amount would come from the highest-paid 20% of residents. This money would empower Alabama to end the state grocery tax without cutting a dime of funding for public schools. And after untaxing groceries, lawmakers still would have more than $300 million in new revenue every year to strengthen investments in K-12 and higher education.

Bottom line

The FIT deduction is a nearly 60-year-old bad idea. It takes money away from our children’s schools. It forces the Legislature to tax groceries and other necessities instead of income from wealthy residents. And it provides a giant tax loophole for the richest people in our state. By abandoning this failed experiment, lawmakers can help make our state more just and inclusive and build a brighter future for every Alabamian.