The American Rescue Plan Act (ARPA) temporarily expanded the Child Tax Credit (CTC) for hundreds of thousands of Alabama children last year. The law also temporarily increased the maximum Earned Income Tax Credit (EITC) for workers without children and broadened the age range for EITC eligibility. Alabama Arise joined 51 partner organizations Tuesday in a letter asking Alabama’s U.S. senators, Richard Shelby and Tommy Tuberville, to support renewing these CTC and EITC improvements this year. The full text of the letter is below.

Letter text

Dear Senators Shelby and Tuberville,

Our nation’s historically high child poverty rate is a choice. Recent U.S. Census data reveals a fundamental truth: Congress has the power to make a different choice. Congress can and should put families and workers first by expanding the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC). These strategies have proved effective to reduce child poverty and boost incomes for people who work but aren’t paid enough to make ends meet.

We, the undersigned organizations representing people with low incomes in Alabama, are writing to urge you to prioritize expanding these programs as part of the anticipated end-of-year budget bill. The time to pass these policies is now, as this may be the last chance this Congress has to act.

Even as Congress has this tremendous opportunity to deliver for families and workers, press reports indicate lobbyists are pressuring Congress to deliver more significant tax breaks for businesses and corporations. One example is the push for a tax break for companies engaged in “research and experimentation,” including tech, pharmaceuticals and other large corporations.

We urge you to put families and workers first. There should be no expanded tax breaks for businesses and corporations without expanding the CTC and EITC.

Under current law, too many children in families with the lowest incomes receive no CTC or receive a smaller credit than children in families with higher incomes. Expanding the CTC so that it reaches more of those children will go a long way toward improving families’ ability to make ends meet and reducing child poverty.

As you know, the American Rescue Plan Act (ARPA) temporarily expanded the CTC for 480,000 children in Alabama, but the expansion has expired. The overwhelming majority of families with low incomes used ARPA’s monthly CTC payments to cover everyday challenges and basic expenses, such as food, utilities, rent and diapers. Before ARPA was passed, roughly 27 million children received less than the full CTC, including many who got no credit at all — not because their families earned too much, but because of a flaw in the law that excludes kids from families with the lowest incomes. Those children excluded from the full credit include roughly half of all children in rural areas.

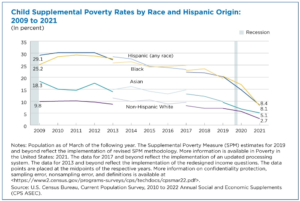

The Rescue Plan’s CTC expansion, combined with other relief efforts, helped lower child poverty by more than 40% between 2020 and 2021, Census data shows. Investing in children in low-income families by expanding programs like the Child Tax Credit also has shown success in improving outcomes for those children over their whole lives, including higher educational attainment, better health and higher earnings as adults.

We also urge you to expand the EITC for workers paid low wages who do not have children living with them. This part of the EITC has not been adjusted for nearly 30 years (outside of a temporary, one-year Rescue Plan expansion). As a result, about 6 million of these workers 19 and older have incomes below the poverty line, once federal taxes are taken into account. This commonsense proposal is long overdue and has enjoyed bipartisan support in the past.

Congress has a critical choice to make now: Will it expand the CTC and EITC, to put more kids on an upward trajectory for life and help working people make ends meet? Or will it go home without reaching a bipartisan agreement on these straightforward policies?

We hope we can count on you to fight for these policies to support kids and workers – and to make sure any final legislative package in December doesn’t give more tax breaks for corporations without supporting Alabamians.

Should you have any questions, please do not hesitate to contact Robyn Hyden with Alabama Arise at robyn@alarise.org. We appreciate your time and your consideration of our views.

Signatories

¡HICA! Hispanic Interest Coalition of Alabama

Advocacy for Social Justice Team of the North Alabama Conference of the United Methodist Church

AIDS Alabama

Alabama Appleseed Center for Law and Justice

Alabama Arise

Alabama Civic Engagement (ACE) Coalition

Alabama Coalition for Immigrant Justice

Alabama Council on Human Relations (ACHR)

Alabama Forward

Alabama Institute for Social Justice

Alabama Justice Initiative

Alabama Possible

Alabama State Nurses Association

Bay Area Women Coalition, Inc.

Beloved Community Church, UCC

Chat World Home Daycare

Childcare Resources

Cody S. King Home Daycare

Communities of Transformation

Community Action Association of Alabama

Community Enabler Developer, Inc.

Community Food Bank of Central Alabama

DayKara’s Group Home

Dee’s Daycare

Edmundite Missions

Fairhope Friends

Faith in Action Alabama

First Christian Church (Disciples of Christ) of Montgomery

First Presbyterian Church of Birmingham

Gadsden Outreach Ministries

Grace Presbyterian Church, Tuscaloosa

Greater Birmingham Ministries

Hometown Action

Jobs to Move America

League of Women Voters of Alabama

Monte Sano UMC

Montgomery PRIDE United

Mrs. Mazaheri’s Day Care

NAACP: Tuscaloosa Branch

Nana’s Nursery

North Alabama Peace Network

Open Table UCC

Project Hope to Abolish the Death Penalty

Redemption Earned, Inc.

Restorative Strategies

Sisters of Mercy in Alabama

SPLC Action Fund

Unitarian Universalist Church of Birmingham

University of Montevallo Alabama Arise Student Chapter

Valley Christian Church

Volunteers of America, Southeast (VOA)

YWCA Central Alabama