Arise’s Akiesha Anderson brings you up to speed on all that happened last week at the State House plus gets you ready for the upcoming week. As the session is nearing an end, we still have action to take on securing public transportation funding and increasing penalties for child labor violations. We also are trying to curb anti-union and anti-immigration legislation. See more at alarise.org and clicking “Take Action.”

Hi there, Akiesha Anderson here, Policy and Advocacy Director for Alabama Arise here to give you yet another legislative update for the week of April 22.

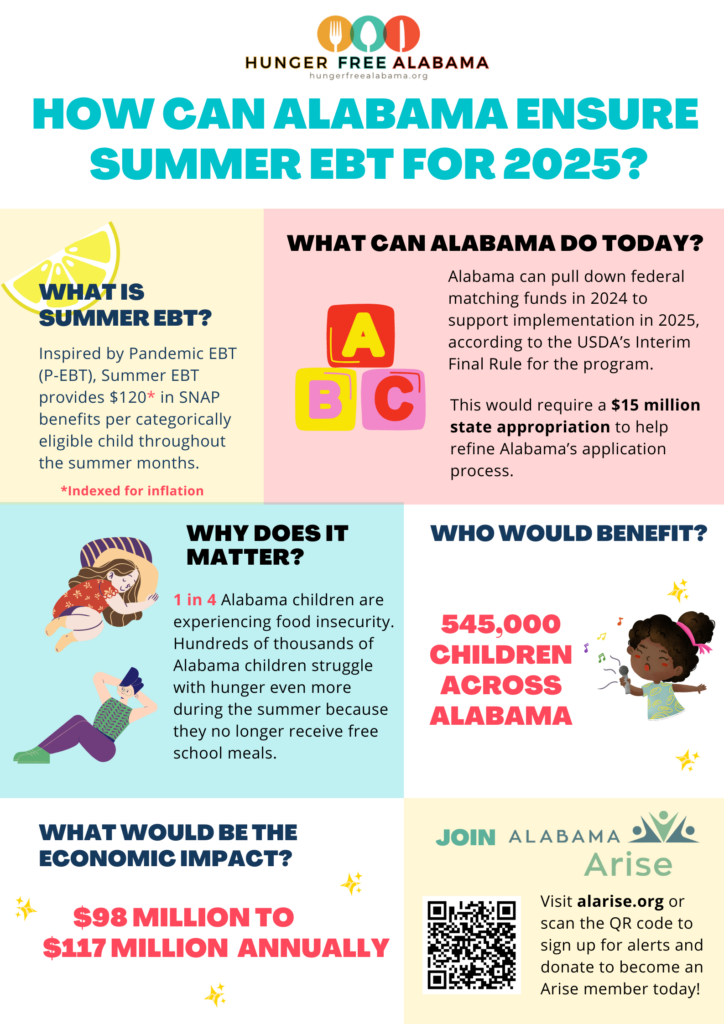

Last week, quite a bit happened but I’m going to start with the Education Budget. So as you know, we are down to just a few legislative days left. Tomorrow when legislators go into the State House they will be on the 24th out of 30 legislative days. And it is essential that the legislature passes the Education Budget as well as the General Fund Budget. So last week we did see the Education Budget make it out of the House to be sent over to the Senate. One unfortunate reality about the Education Trust Fund budget is that unfortunately the $15 million needed for Summer EBT was not included in the House’s version of the budget. This is really unfortunate. We are still going to continue to push to see if we can get that money added to the budget in the Senate but I do want to make note that the House felt to allocate this money even despite the fact that there was a $15 million surplus or $15 million bucket of money that was set aside for Birmingham Southern back when the state intended on giving it a loan to bail it out of its financial trouble. There was $15 million that was previously allocated for Birmingham Southern that instead was allocated to a quasi slush fund for legislators basically to give out community grant money. And so Arise believes that this $15 million would be much better used ensuring that over half a million children have summer meals when school is out and so we are hopeful that we can make that argument in the Senate and we can ensure that children get fed over the summer.

Also related to budgets, last week HB 358, which is a bill sponsored by House Minority Leader Anthony Daniels. This piece of legislation was a childcare tax credit bill and it passed out of the House and so that is good news. It means that women and others that occasionally are forced out of the workplace to do caregiving for children might have some alternative ways to be in the workforce and ensure that they also have child care available. Some unfortunate yet also some good movement on several bills related to workers rights was seen last week. However, I will talk about that in more detail when I talk about what we’re watching this week at the State House.

But also last week we saw quite a bit of movement on some criminal justice related bills. So the judicial override bill sponsored by Rep. England as well as a bill requiring a unanimous jury before sentencing someone to the death penalty sponsored by Sen. Hatch, these both died in committee last week. So that was really unfortunate to see that the death penalty legislation that we were watching did not make it out of committee either in the senate or in the House Judiciary Committee last week. Despite that, however, there were some good parole bills that passed out of committee. This included HB 299 by Rep. England which essentially would create an appeal process for some people whose parole is denied. There also was movement on SB 312 by Sen. Barfoot. This piece of legislation also passed out committee and this would allow people to attend their parole hearings virtually. So that was really nice to see that there is some positive traction with regard to some parole bills. However, it remains to see be seen how much time is left in session whether or not these bills can make it over the finish line. Another piece of legislation that’s quasi criminal justice related a bit more education related, however, and that does have time to make it throughout the through the whole process for certain are some pieces of legislation introduced by Sen. Smitherman as well as Rep. Collins that would provide due process rights to students in K-12 Public Schools. So essentially if these pieces of legislation pass K-12 public school students will not be able to be suspended or expelled without certain due process criteria being met, essentially allowing them to tell their side of the story before they face those really harsh consequences that the school wants to impose.

Now, moving forward to this week. There are quite a few things that we are watching.

So first and foremost on Wednesday at 9 a.m. there is a Joint Health Committee meeting in which there will be a hearing on solutions for closing the health care coverage gap. And so we are super excited about that. This is only the second time in years that the legislature has spent time actually talking about the need for Medicaid expansion or addressing the health care coverage gap that we currently have in the state of Alabama so we’re looking forward to seeing what happens at that hearing. But we will definitely be in attendance and we hope that you are there as well if not able to make it in person definitely stream it online.

Also happening this week, SB 91 will be up in Finance and Taxation General Fund Committee in the Senate at 11:00 a.m. on Wednesday. This piece of legislation will be deliberated and for those of you who recall this is legislation that’s designed to create a source of funding for the Public Transportation Trust Fund. So we are super excited to see that this piece of legislation is getting a chance to be heard in committee this week.

A piece of legislation that we’re a bit concerned about this week is HB 376 which is introduced by Rep. Yarbough and this piece of legislation is an anti-immigration bill that essentially allows localities to enter into contracts with the federal government to become quasi agents of I.C.E. for a lack of better terms. And so proxies for I.C.E. and so this is a piece of legislation that we are fearful will cause a chilling effect on how included, how welcomed, how included yeah our neighbors feel here in the state of Alabama. And so we are hopeful that when that bill comes up in Public Safety and Homeland Security Committee at 9:00 a.m. on Wednesday that it will not make it out of committee.

The good thing about today’s update is that time is running out to pass harmful legislation and so even if that piece of legislation does make it out of committee we are hopeful that it will not make it throughout the process with there being only seven legislative days left in the process. Time is definitely running out. However, we are closely monitoring the final weeks of session and some bills that we do anticipate being deliberated on the full House floor this week include those workers rights bills that I referenced earlier.

So SB 231 for example, which is an anti-union bill that penalizes companies for voluntarily recognizing workers that decide to unionize, that piece of legislation is first on the special order calendar in the House tomorrow which means that when the House gets ready to deliberate legislation this will be the first piece of legislation that they deliberate. And this is a piece of legislation that we strongly oppose. Another piece of legislation related to workers rights that will be on the House floor tomorrow if the legislature makes it that far is SB 119 and this is a piece of legislation that would increase penalties for child labor violations. And so that is something that we are excited to see only has one more favorable vote needed before it will make its way to the governor’s desk. And so we are hopeful that that piece of legislation passes tomorrow and also hopeful that SB 231 fails.

And so that my friends is what is happening this week, that is what happened last week and we will be sure to keep you posted on things that continue to happen at the State House for as long as the legislature is in session. Take care.