Arise’s Robyn Hyden testified to the Senate’s education budget committee Wednesday in support of SB 144. The bill, sponsored by Sen. Andrew Jones, R-Centre, would eliminate Alabama’s state sales tax on groceries and replace the lost revenue by capping the state deduction for federal income taxes. Here’s the full text of Hyden’s prepared remarks:

Good morning! I’m Robyn Hyden, executive director of Alabama Arise. We’re a nonprofit coalition of 155 congregations, organizations and individuals promoting public policies to improve the lives of Alabamians with low incomes.

For our 31-year history, Alabama Arise members have advocated to remove barriers to opportunity for people who struggle to make ends meet – and ending the grocery tax is at the top of our list of policy goals. Last month, we brought 200 advocates to the State House to ask you all to consider several ways to remove the grocery tax. And we are very pleased to see this bill receive your attention today.

We believe that while the grocery tax is an unjust burden on people who simply need to eat, the flip side is that the federal income tax (FIT) deduction is a giant and unfair tax loophole, allowing people with higher incomes to pay a lower percentage of their overall earnings. Only two other states still allow the full FIT deduction, and only two other states fully tax groceries.

The grocery tax brings in about $480 million a year, while the entire FIT deduction for individuals costs our budget more than $719 million a year. Essentially, we are subsidizing our reliance on this giant tax loophole with a ridiculous tax on food.

How to end the state grocery tax responsibly

We shouldn’t continue to subsidize an unfair tax loophole with an unjust grocery tax. We support Sen. Jones’ proposal because it would end this unfair tax shift by capping the total FIT deduction allowed. This would allow working families who pay federal income taxes to still benefit from the deduction, but also would prevent the Education Trust Fund from losing revenue.

Our modeling of the impact of SB 144, completed by the Institute on Taxation and Education Policy, shows that this bill would generate a conservative estimate of an additional $474 million a year to the ETF. That’s almost an even swap for grocery tax revenue that would be returned to taxpayers.

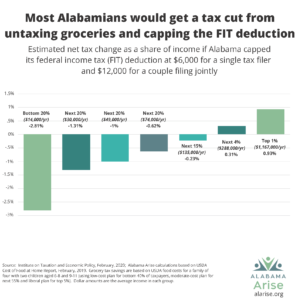

If you look at the chart I’ve shared with you, the blue and green bar graph shows the impact of both removing the grocery tax and capping the FIT deduction on the average household at each income level. Notice that for the bottom 95% of taxpayers, the combination of removing the grocery tax and ending the FIT deduction produces a net tax cut.

For lower- and middle-income families, it’s quite a significant cut. It’s only for households making well above $135,000 a year that any type of significant net increase is going to happen. When you consider that the median household income in our state is just $48,123, what we’re looking at here is effectively the biggest tax cut affecting the most people that you’re ever going to get a chance to vote on.

I thank you for your time today. And I urge you to consider this proposal to bring tax relief to hard-working families and bring more fairness to our tax code.